The agency seeks to show the efficacy of additional funding.

The Internal Revenue Service (IRS) has shown improved phone response metrics as the tax season kicks off, reportedly achieving 92 percent of calls accepted and reducing average hold time to less than two minutes. During the 2022 tax year, the agency could only serve 15 percent of those who called the main phone line. After budget increases, IRS phone service increased to 87 percent in 2023.

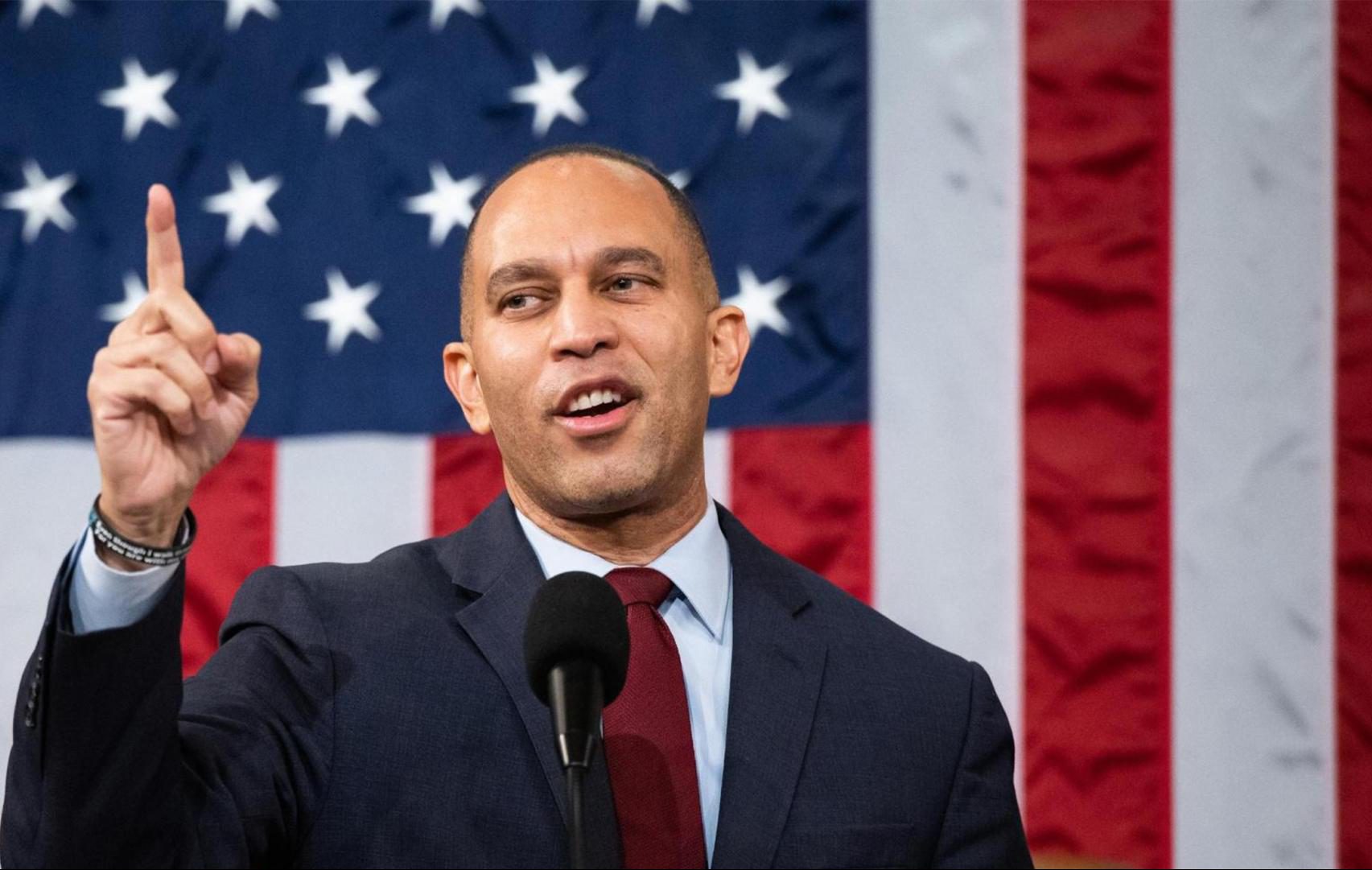

“Taxpayers are benefiting from significantly improved service on the phone, in person and online this filing season thanks to resources from President Biden’s Inflation Reduction Act,” Treasury Deputy Secretary Wally Adeyemo stated, pointing to the increased budget as the reason for the improvements.

The 2022 Inflation Reduction Act allocated $80 billion for ten years of IRS operations, allowing the tax filing agency to operate at full employee capacity for the first time in decades. Some members of Congress, concerned with the national debt, have considered revoking some of that funding in future legislation. The IRS hopes to show the value of the increased funding in the improved metrics.

As the Lord Leads, Pray with Us…

- For Commissioner Danny Werfel to receive God’s direction as he heads the Internal Revenue Service.

- For Deputy Secretary Adeyemo as he reviews budgeting and operational improvements in the Treasury Department.

Sources: Reuters, Investing.com